Home ownership has long been a great wealth-building tool for everyday families. But for over a decade, corporations have invested heavily to gulp the hikes in property values for themselves. And thus far, they are succeeding.

There’s nothing inherently unjust about rent itself, provided the terms are fair and agreeable, and both parties act in good faith to meet their ends of the deal.

But that describes an unfitting ideal of the situation large-scale corporate landlords are creating.

It's possible you’re already put off by the cynicism I've expressed about corporate actors. Why, isn’t that just the free market at work?

Actually, no.

As I’ve argued, corporations are artificially privileged creations of the state. They are not simply products of free association that act within the constraints of natural persons.

To serve tenants, landlords must be…

Local

Responsive

Subject to Market Discipline

Legally Held Accountable

The question isn’t how these legs of the footstool have organized themselves, but which one - if any - even remains under a corporate rentership society.

To be headquartered far away by definition makes an entity unresponsive. All the more if the bureaucracy is a consumer's burden by design. Institutionally imposed acts of moral hazard - such as implicit bailout guarantees - circumvent the process of economic corrections and market discipline. Massive legal departments ready to assert any “gotcha” clause in the fine print are conveniently shielded even from seemingly legitimate complaints from a tenant.

In the book Who Owns America, economist Richard B. Ransom identified three major distinctions corporations have from natural persons.

I. They are permanent, except as an occasional corporation is limited in its tenure of life by some special legislative grant or charter. On the other hand, the term of a natural person is limited by his expectation of life, and at his death his estate is divided among his heirs and further diminished by the taxation of inheritances.

2. Their responsibility is impersonal, and the responsibility of their organizers and owners is limited by statute or charter. The responsibility of the private individual for his acts and for his debts, however, is personal and unlimited, and extends from his person to his entire estate rather than to a particular form of liability or limited type of transaction.

3. Corporate management may in practice be entirely independent of its titular or actual ownership; but as to the property of private persons, this is not ordinarily practicable for any considerable length of time.

In a recent episode of the Human Action Podcast, co-host Robert Murphy addressed the phenomenon of large corporations buying out residential communities.

There is this phenomenon now where a lot of the purchases now are not buy into, you know, families moving into the home, but they're buying, these institutional buyers, presumably for speculative reasons. And… if it's like Blackrock or somebody comes and gets Warren Buffett, people are saying Bill Gates is buying a lot of farmland… just do the quick economics of that, again, in this politically-connected… cronyism system.

It's not a true free market, don't get me wrong, but in terms of the logic of it, that per se is not a bad thing that you know, some some hedge fund or some institutional money manager wants to buy real estate…

When the bubble bursts… they're caught with their pants down. But again, that all emphasizes or underscores the the necessity that the government and the Fed needs to just stand back and let these buyers take losses if you bail them out.

So if they make money on the upside, if they're right in their speculative bets, and then… if they get caught and there's a crash, and you bail them all out because they're too big to fail, well then that kind of defeats the purpose. So you know, here it's more of a theoretical point.

But yeah, in a genuine free market, the fact that these institutional buyers are coming in and might make homes unaffordable for the regular guy in certain markets. That per se wouldn't be a bad thing. Because you know, profit and loss would discipline them.

Thus, in short, a free market would (keyword: “would”) correct the damage done if these purchases were not institutionally backed by the Federal Reserve's primary beneficiaries, and the moral hazard of “too big to fail” firms that enjoy implicit bailout guarantees, as was materialized in the TARP program following the housing bust in 2009.

If we are to anticipate a repeat of such interventions with the system as is, frankly, it is “a bad thing” - and that’s a borderline perverse understatement. And perhaps it's a defensive motion to prevent a cronyist system from rigging the game. How much pain would a community save itself by opting out from a corporate takeover of its residential communities?

Not in Blackrock's Backyard

NIMBYism (Not In My Backyard) is often thrown around as a term of art when one wishes to have the surroundings of his property reflect his preferences. Perhaps a NIMBY attitude towards Invitation Homes and Colony Capital would apply. But if you thought NIMBYism was a problem, wait until you have NIBBYism replacing it: Not In Blackrock's Backyard.

In the name of attracting business, municipalities may be considering corplord-friendly zoning laws. Neighbors near you may be wholly unprepared to turn away men in suits with impressive checks to offer upfront with burdening strings attached in the long term. Suddenly, that sacredly-held picture of your mother on the wall may no longer be a given, but a subject up for debate.

Whether history repeats itself or merely rhymes, the fundamentals of the system favor these protected entities out of fear of a ripple effect, should they go belly-up. In the eyes of those that wield power, a single family going underwater and losing their home is replaceable by the next sucker in line.

In addition to Murphy's point, would a true free market even allow for the corporate form to exist?

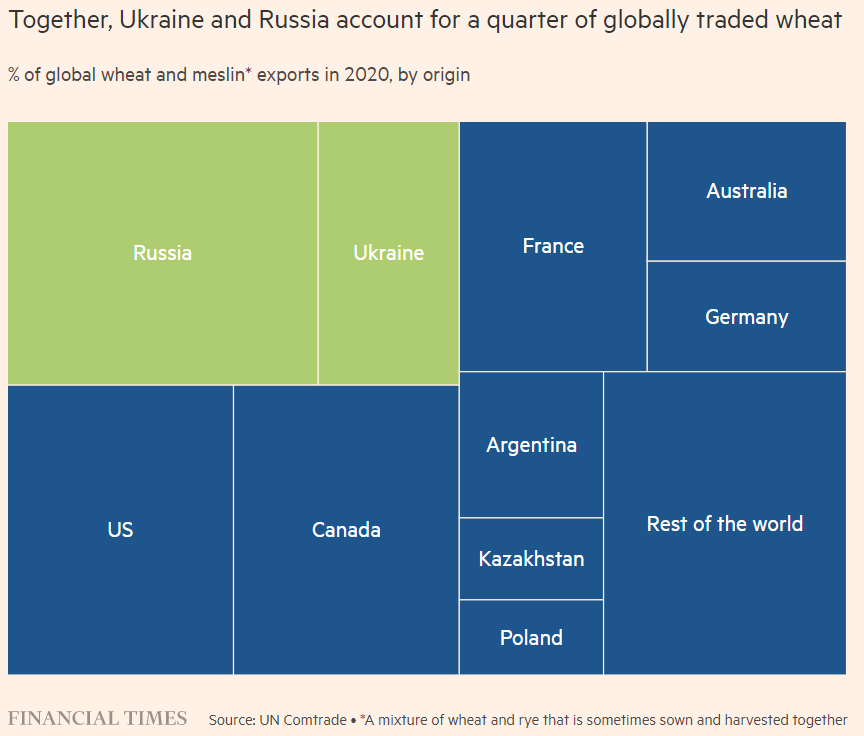

Asserting “tin foil” prerogative - given the nature of this piece - is it a coincidence that the US may face a food shortage following the mass purchase of farm land by Bill Gates?

To be sure, a war between two “breadbasket” nations hasn’t helped to force prices any lower on wheat, fuel, and other necessities. The reverberating ripple effects are picked and chosen, and the pet projects of the day are institutionally shielded from the chaos.

Rentership Society as Housing 2.0

On July 20, 2011, Morgan Stanley released a report entitled Housing Market Insights: A Rentership Society, proclaiming the dawning of a new era of opportunity for corporate buyouts of residential homes.

The combination of falling home prices, limited mortgage credit, continued liquidations, and better rental options is fundamentally changing the way Americans live. We believe this change is only beginning, and is moving the country towards becoming a Rentership Society.

Later in October, a follow-upreport entitled Housing 2.0: The New Rental Paradigm had essentially declared this strategy cemented as a top priority.

“The beginning of the rentership society is upon us,” it boldly declared.

For the past few months, we have written extensively about our view that America is moving away from a home ownership society and towards a Rentership Society. We have also detailed a proposal, dubbed REBUILD, to help take advantage of the increase in investor demand for distressed residential properties to repurpose them for rentals, to hélp address the backlog of distressed homes and alleviate a major housing market issue. As institutional ownership of Single-family rental properties grows, hopefully with the help of government intervention, but even without it, we believe that the housing market is already beginning to undergo that fundamental change to support a more renter-heavy society. In fact, we believe that we are in the early stages of the development of a new institutional-owned asset class: Single-family real estate.

Taking full advantage of the woes facing the housing market, the transition towards rentership was set as a targeted objective for investment.

Given the declines in homeownership, availability of single-family housing, projected liquidations and increasing capital investment in single-family real estate, we see the Rentership Society driving the development of an institutionally owned single-family rental market. Taking into account the distressed pricing, strong rent environment, and what we believe will be increased demand for single-family rentals, we believe this as an opportunity to invest in Housing 2.0.

Slave to the Lender

There are five primary corporations dominating this market:

Invitation Homes

Tricon American Homes

Progress Residential

Main Street Renewal

Colony Capital

According to Ryan Dezember of the Wall Street Journal…

Home-price appreciation has historically been how Americans achieve financial prosperity… Unlike stocks and bonds, ownership of which is concentrated at the top, houses are widely held. Roughly half of housing wealth is owned by America’s middle class.

This source of prosperity is necessary to service private debt, currently sitting upwards of $27 trillion, claiming two of every three Americans.

In his book Underwater: How Our American Dream of Homeownership Became a Nightmare, Dezember details how the 2008 Housing Crisis presented corporations with the opportunity to buy residential homes en masses for the purpose of renting them out.

Dezember stresses the tragedy of an American dream gone south, moving towards a forgotten man.

Home-price appreciation has historically been how Americans achieve financial prosperity… Unlike stocks and bonds, ownership of which is concentrated at the top, houses are widely held. Roughly half of housing wealth is owned by America’s middle class.

But in 2018, one out of every ten suburban homes was bought by a corporation. By July 2020, corporations claimed ownership of 300,000 American homes.

By 2020, Blackrock was the biggest beneficiary of exchange-traded fund purchases from the Federal Reserve. Blackrock also ran the Fed’s three debt-buying programs.

Recommended Podcast:

External Resources:

Who Owns America: A New Declaration of Independence by Herbert Agar and Allen Tate

Human Action Podcast: The Crazy Housing Market

PDF: Housing Market Insights: A Rentership Society by Morgan Stanley

PDF: Housing 2.0: The New Rental Paradigm by Morgan Stanley

How corporations are buying up houses — robbing families of the American Dream by Larry Getlen

BlackRock is the biggest beneficiary of US Fed’s ETF buying by Leslie P. Norton

Against the Corporate Form Part I by Mr. Jeffersonian