The Power We Forfeit

At the risk of sounding like a Keynesian, I offer the following observation:

In an environment so far removed from any real semblance of a free market, we should be particularly concerned about the upward redistribution of wealth, because less of it is coming back to us.

Downward redistribution, for all its evils, will still be exchanged within the economy, and not tied up in investments and savings of the uber-wealthy.

Time Stamps:

Opening/Announcements (0:00)

The Power We Forfeit (1:36)

Fairness Need Not Apply (2:25)

The Biggest Gusher of Corporate Welfare Ever (3:51)

Large, Complex, and Ambitious (7:03)

Economic Life Can Only Be Understood Looking Backwards (12:41)

Massie Throws a Diluted Tea Party (14:24)

Obviously, I'd rather see taxation cut directly - lots of it - and consumers reclaiming their rightful role in picking winners and losers. But when we demand that government actors strengthen a certain set of industries, that's precisely the power we forfeit.

Fairness Need Not Apply

In President Joe Biden's recent State of the Union Address, he proclaimed:

I want to talk about the future of possibilities that we can build together — a future where the days of trickle‐down economics are over and the wealthy and the biggest corporations no longer get all the tax breaks…

It’s my goal to cut the federal deficit another $3 trillion by making big corporations and the very wealthy finally beginning to pay their fair share…

The way to make the tax code fair is to make big corporations and the very wealthy begin to pay their share.

But if you're running a massive corporation that might potentially benefit Biden's political agenda, none of this “fairness” talk applies to you. Instead, you can enjoy a massive subsidy in the name of Bidenomics, an embarrassing slogan that's grown synonymous with debt, waste, and inflation. And even if you weren’t targeted to benefit, you can purchase tax credits from other companies.

The Biggest Gusher of Corporate Welfare Ever

At face value, Biden is delivering the script that motivates voters by their sense of “fairness” and “progress” into supporting the Democratic Party. But in practice, these values are two-faced. We can say as much by noting that Biden signed three big-spending bills…

Infrastructure Investment and Jobs Act of 2021

CHIPs and Science Act of 2022

Inflation Reduction Act of 2022

And all three largely stood to benefit large corporations, best collectively described by Chris Edwards as “the biggest gusher of corporate welfare ever.”

Or, as Veronique De Rugy put it:

Unfortunately, when you look behind the smoke, mirrors, and rabbits hidden in hats, you'll see that promises to rebuild America through industrial policy are just plain old corporate welfare.

“But hey,” you say.

“Didn't it create jobs?”

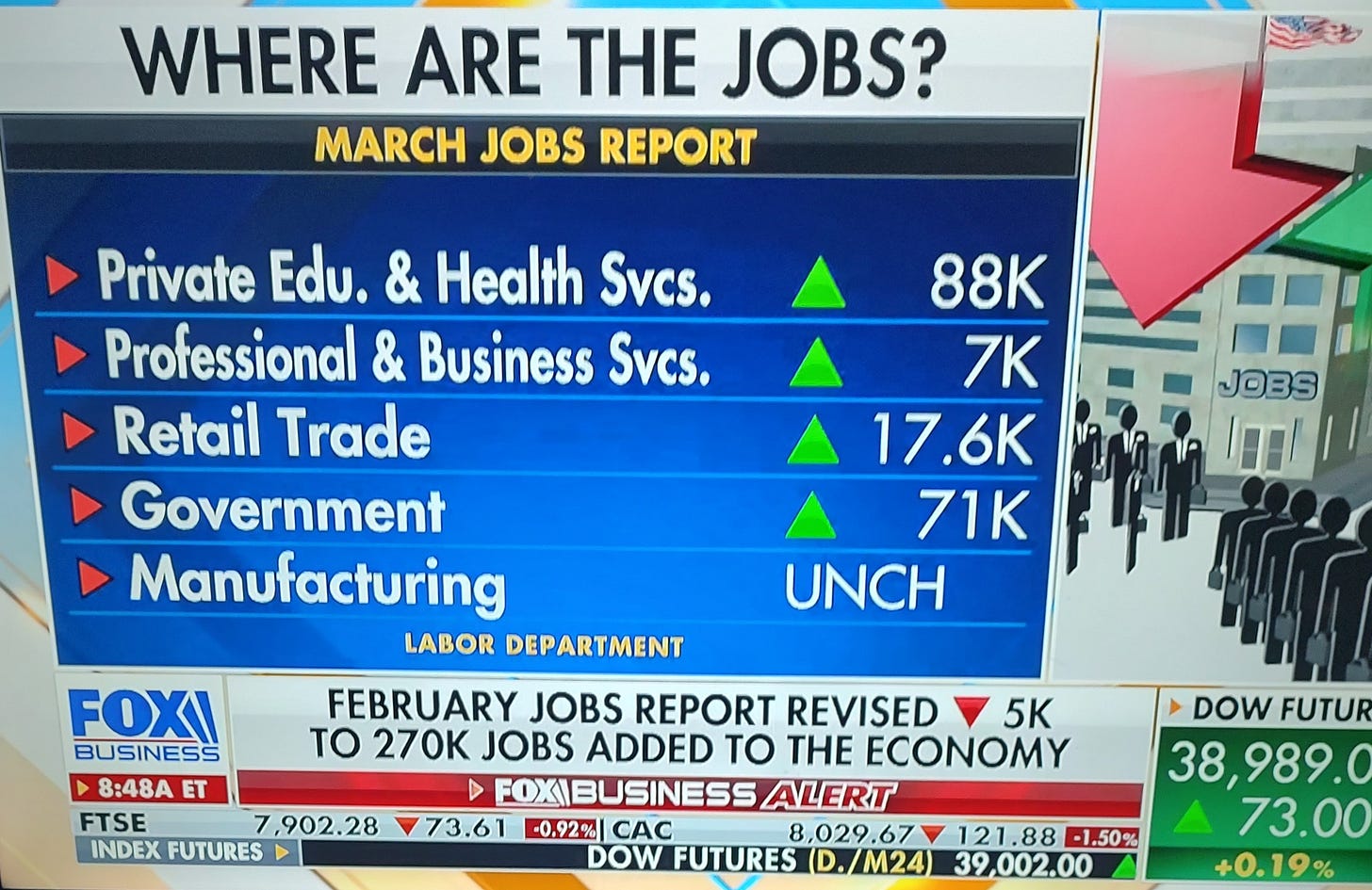

Based on the manufacturing data from the March jobs report, it didn't even create a total of one in that sector.

Arjun Singh of the Daily Caller explains:

The number of manufacturing jobs in the United States remained at 12,956,000, the same figure as February, following a decline of 10,000 jobs from January, according to the Bureau of Labor Statistics (BLS) Employment Situation Summary released on Friday. The figure comes despite the Biden administration launching an aggressive campaign to increase manufacturing employment through public subsidies enacted under the Infrastructure Investment and Jobs Act (IIJA) of 2021 and the Inflation Reduction Act (IRA) of 2022."

If it's the same figure as the previous month, there is no net gain. None.

Large, Complex, and Ambitious

Even if you're a corporate welfare recipient, you'll have to take a number. From the red ribbon to the red tape, you'll find yourself in line for a different kind of hold up.

After a year in a half since the passage of the CHIPS Act, Christopher Tang voices such concerns in Industry Week, as plants for electric vehicle battery and semiconductors are being delayed.

[T]he complexity of the application process and the slow pace of fund approvals have dampened enthusiasm. And high labor and material costs, coupled with the difficulty of meeting subsidy eligibility requirements—specifically, that high percentages of building materials and components must be sourced from U.S. suppliers—have posed significant challenges. With many firms concurrently building new facilities, certain components like switchgears and transformers provided by U.S. suppliers are in short supply. As a result, firms face wait times exceeding 100 weeks...

Over 170 firms have applied for funding under the CHIPs act. However, apart from a $1.5 billion grant awarded to GlobalFoundries in February, only two minor grants had been issued, to manufacturers of less advanced chips, by the end of January.

Without a concerted effort to fund various projects, doubts may arise about the U.S. government’s commitment to semiconductor and EV manufacturing. This could lead to cancellations and delays, making it challenging to compete with China.

Infrastructure spending has long been a crowd-pleaser for Democrats to run on, and for Keynesian economists to embrace.

James Madison reluctantly vetoed an infrastructure bill as his last act as President because it was unconstitutional. But that's a story for another time.

For now, we will walk through the rough economics of it, and see if it even makes sense to begin with.

Department of Transportation Secretary Pete Buttigieg boasts that the 2021 Infrastructure Investment and Jobs Act allows for project grants “so large, complex, and ambitious that they could not get funded under the infrastructure programs that existed prior to this administration.”

At the time of its passage, the general consensus was that it was a year of economic recovery. After all, we'd just been through Covid-19 and the setbacks entailed from its policy response. Plenty of haggling took place over whether it was technically a recession.

Keynesian economist Paul Krugman stressed the situation as to say, “spend, on anything, quickly.”

The key thing, when you're in a situation like this, is realizing that normal rules don't apply. Ordinarily we'd welcome an increase in private saving; right now we're living in a world subject to the "paradox of thrift," in which private virtue is public vice. Normally we want to be careful that public funds are spent wisely; right now the crucial thing is that they be spent fast. (John Maynard Keynes once suggested burying bottles of cash in coal mines and letting the private sector dig them up — not as a real proposal, but as a way of emphasizing the priority of supporting demand.)

Economic Life Can Only Be Understood Looking Backwards

Economists often note that idle resources are definitive of a depressive economy. Market signals alone fail to put men on machines, working to complete ostensibly useful projects. On its own, the cost-benefit calculation renders such projects as less than optimal.

But as Soren Kierkegaard famously put it, if life is to be lived forward, it must be understood backward. And to understand the situation properly, we must ask how we ended up with it to begin with.

Austrian School economist Bob Murphy breaks down the disconnect that this retrospective assessment reveals.

Writers such as Krugman and Thoma act as if recessions are caused by massive bouts of irrational consumer anxiety, and that all problems can be patched up by a simple boost of "aggregate demand."

On the contrary, the economy's capital structure really was thrown into an unsustainable condition during the boom years, and it takes time for the mess to be sorted out. When the government runs up a deficit to fund "stimulus" projects, all that really means is that it is forcing taxpayers to pay for projects that they wouldn't buy with their own money...

Private investors are fleeing to real goods because they are uncertain, and making trillions of dollars subject to political deals, rather than consumer choice, only increases the uncertainty over future conditions. Pro-stimulus economists can keep bringing up new aspects, but each new consideration just proves how counterproductive their proposals are."

Massie Throws a Diluted Tea Party

It was eventually acknowledged that the Inflation Reduction Act was never actually designed to combat inflation.

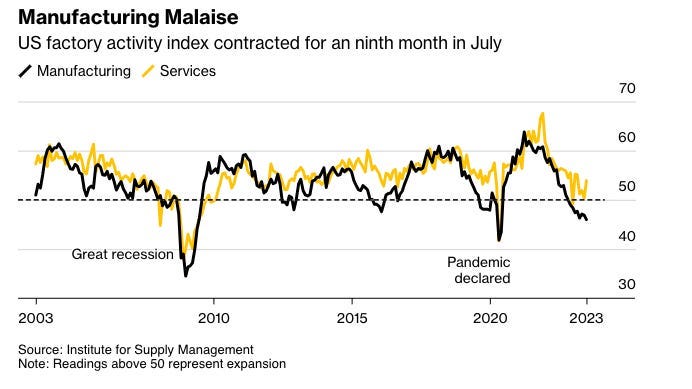

Economist Peter St. Onge called the sluggish trend of subsidized manufacturing out in a devastating takedown article from August of last year:

The key is that, like all government handouts, the dollars are big, but they're not "investment," they're waste. Most of the new factories are taxpayer-subsidized, especially in "green energy," including many built by foreign companies from, above all, China…

In truth, the manufacturing PMI, which measures the broad health of American manufacturing, has been dropping since March of 2021 -- 2 and a half years now. And it's at the lowest level since just before the 2008 crisis.

Very little has changed, and “waste” is hardly unwarranted. Since Biden took office as President, so-called “investments” in manufacturing have gone through the roof. And for what?

Adam Michel has pointed out that if made permanent, the subsidies in the so-called Inflation Reduction Act could exceed $1.8 trillion.

I'd love to believe that the next Congress - and hopefully, the next Administration - is absolutely energized to toss this legislation out of existence. But as Milton Friedman famously said, “[n]othing is so permanent as a temporary government program.”

External Resources:

Politicians Are Showering Manufacturing Companies With Crony Subsidies for 'Job Creation.' It Won't Work. by Veronique De Rugy

Biden’s Corporate Welfare Bonanza by Chris Edwards

Biden's Fake Manufacturing Boom by Peter St. Onge

Not A Single Manufacturing Job Was Created In March Despite Biden Admin Spending Billions To Do So by Arjun Singh

Energy Tax Subsidies Could Top $1.8 Trillion by Adam N. Michel

Speed Up CHIPS Funding, Before It’s Too Late by Christopher S. Tang

Does "Depression Economics" Change the Rules? by Robert P. Murphy

Donate to Mr. Menger:

Tip with Buy Me a Coffee

Tip with Cash App

Substack Companion Article: Biden's Trickle-Down Manufacturing Crony Bomb

Share this post